Listen to This Article

Audio Recording by Audm

To hear more audio stories from publications like The New York Times, download Audm for iPhone or Android.

Before it was the cardboard on your doorstep,it was coarse brown paper, and before it was paper, it was a river of hot pulp, and before it was a river, it was a tree. Probably a Pinus taeda, or loblolly pine, a slender conifer native to the Southeastern United States. “The wonderful thing about the loblolly,” a forester named Alex Singleton told me this spring, peering out over the fringes of a tree farm in West Georgia, “is that it grows fast and grows pretty much anywhere, including swamps” — hence the non-Latin name for the tree, which comes from an antiquated term for mud pit. “See those oaks over there?” Singleton went on. “Oaks are hardwood, with short fibers. Fine for paper. Book pages. But not fine for packaging, because for packaging, you need the long fibers. A pine will give you that. An oak won’t.”

Singleton, who is 54, with a shaved head and graying beard, has spent the past few years as a fiber-supply manager for International Paper, or I.P., a packaging concern headquartered in Memphis. (Paper people tend to scoff at the word “cardboard,” which they consider inaccurate and a little gauche.) Among the big conglomerates that dominate the North American sector of the flourishing cardboard industry, I.P. is the biggest: The company is responsible for a third of the boxes created in the United States. Singleton’s job, as his title indicates, is to source enough loblollies to help keep I.P.’s production lines humming.

Stacks of unprinted, uncut cardboard at the International Paper factory in Lithonia, Ga.Credit…Christopher Payne for The New York Times

“You’re sort of always in a race,” he said. “You learn to get creative.” The foresters on Singleton’s crew spend much of their time zipping around the Southeast by pickup, using a proprietary smartphone app to monitor tracts of harvestable woodland. Many of the tracts are maintained by commercial tree-farming concerns well known to I.P.; others are on land belonging to local or state governments. “Then you’ve got the families who might harvest once in their lifetime,” Singleton said, “in order to buy a car or send their kids to college.” After a deal is struck with the landowner — the fee is based on total tonnage, and the location and quality of the timber — a logging team will remove the trees and transport them by truck to a paper mill.

If the trees in question come from western Georgia or eastern Alabama, their destination is likely to be the International Paper facility in the Georgia city Rome, where Singleton lives. The Rome plant is the terminus for most of the softwood timber logged within a 100-mile radius; when I visited this spring, a line of mud-splattered trucks was assembled on the entry road, flatbeds heavy with pine. “We’ve got about 8,000 tons of trees coming in here every day, and we’re open 24 hours a day, seven days a week,” said Kevin Walls, a manufacturing executive.

“No vacations for you,” Singleton suggested from the back seat of the truck.

“Well, I can take them,” Walls said. “But I’m always on call.”

We drove around the side of the facility to the woodyard, where a crane was removing timber from a log truck and feeding it into the bladed mouth of a cylindrical machine known as a debarking drum. Even from a distance of approximately 200 yards, the drum made a racket. It churned and chewed and spit the denuded trees from its rear end. Another masticating machine, this one a steel chipper. In went the debarked trees, out came a spray of loblolly pine. It was extremely satisfying. I could have sat there all day.

In the mill proper, the air had a tropical clamminess; the dominant olfactory note was of broken-down cardboard left out in the rain. In a series of nearby vats, the chips from the woodyard were entering what’s known as the kraft process (after the German word for “strength”), in which a chemical cocktail is used to break the chipped timber down to a gloppy sludge. “We’re after the cellulose fibers,” Walls shouted through a headset. “The long, strong fibers.”

Later, the chemicals are washed from the resulting mix and recycled, and remaining wood is used for fuel; the pulp is funneled to the “paper machine,” an oddly quotidian appellation for such an impressive contraption. The paper machine stretched across almost the entire mill floor and trembled like a space shuttle just before liftoff. At odd intervals, scorching hot gusts of steam escaped from its guts. Pulp sluiced in and cascaded onto the “former,” where it was flattened into a paperlike consistency.

We walked down the flank of the paper machine, to the “calendering” station, where the water was squeezed from the product. “Next comes the dryer,” Walls said. He pointed to a series of wide spools, over which the paper whirred in an endless brown blur.

The multiton rolls landed on the floor, where they were moved to be cut to size and sent to the loading area to be ferried to separate facilities for corrugation — the folding-and-layering action that makes cardboard cardboard.

Every day, Walls told me proudly, the exercise was repeated enough times to paper over a two-lane highway from the gates of the mill almost to El Paso, Texas, 1,350 miles. Impressive in itself, but to get a real sense of the scale of the modern corrugated industry, you have to do some extrapolation: Take those 1,350 miles and add the output of the 25 other paper mills I.P. maintains from Georgia all the way out to Washington State. Add again the yield from the dozens of paper mills owned by the company’s competitors. Suddenly, you’re no longer talking about thousands of miles of paper, but millions of miles.

And it’s barely enough to meet demand: Cardboard manufacturers broke production records in 2021, and they’ve been breaking them basically every quarter since. By 2025, according to one estimate, the size of the international market for corrugated packaging will reach $205 billion, commensurate with the gross domestic product of New Zealand or Greece.

Most of us have a relationship with cardboard that ranges, depending on the day and our Amazon Prime membership status, from reluctantly reliant to fully subservient. Precise household metrics are hard to come by, but the Fibre Box Association, a trade group, says that American factories generated more than 400 billion square feet of cardboard in 2020, a leap of 3.4 percent from the year prior. Cardboard-box consumption spiked in the early days of the pandemic, when everything we needed arrived at our homes swathed in brown-paper packaging; astonishingly, the trend lines have never really reversed course.

Sometime after the Delta wave of Covid but before the debut of Omicron, I began tracking the number of cardboard boxes my family went through on a weekly basis. To make the experiment easier, I excluded so-called containerboard, the uncorrugated or lightly corrugated material used in juice boxes or milk cartons. I landed at an average of 18 boxes per week, a number that comprised Amazon Prime shipments — gummy vitamins and books and toys and electronics purchases — and produce boxes bundled by our local farm share. It felt like a lot, and it was a lot, but it was far less than the cardboard chewed through by some of our neighbors. Every Monday, I drag two tall blue bins of cardboard to the curb. One guy down the block does four.

On the one hand, there is something a little surreal about the emergence of cardboard as a growth industry — a box, after all, is a commodity whose only purpose is to hold other, more valuable commodities. On the other, it makes all the sense in the world. “Corrugated packaging has a Goldilocks quality to it,” says Tim Cooper, a project director for the market-research and testing firm Smithers. “It’s easy to produce, it’s strong and it’s sustainable, because unlike plastic, it comes from a renewable resource.” (It’s also more recyclable than other shipping methods: Of the 69 million tons of waste recycled annually in the United States, more than 65 percent is fiber-based, according to the most recent E.P.A. figures, from 2018.) “I’m hesitant to call anything recession-proof,” Cooper added, “but corrugated packaging is close. Pretty much everyone — manufacturer and consumer — has come to see it as vital to their lives.” It is the glue that holds together entire industries and regional economies; it is convenience, rendered in three dimensions. In corrugate we trust.

Historically, rates of cardboard production have dipped at moments of recession or depression but generally extended skyward at the same inexorable and gentle rate — until the 2010s, when the lines became considerably more steep. “E-commerce was the fuel on the fire,” Cooper told me. “After online shopping really caught on, that’s the moment corrugated production numbers really went wild.” We wanted more stuff, and we wanted it quickly, and we wanted it without ever leaving our homes. Retailers and the packaging industry were happy to help.

In 2021, Amazon shipped $470 billion of goods globally, in an estimated 7.7 billion packages. I say “estimated” because no one really knows the total number of packages Amazon ships on a yearly basis, and Amazon declined to make that figure available to me. Here’s what we do know: Amazon is delivering more packages than ever before, and at exponentially higher frequencies, to all of its customers, and to American customers in particular.

In 2019, Amazon Logistics, an in-house shipping service responsible for that omnipresent army of blue vans, delivered 1.9 billion packages in the United States. A year later, it delivered more than double that, giving Amazon Logistics a larger market share than FedEx.

In the United States, the greatest beneficiaries of our newfound dependence on corrugate are the so-called Big Five, the paper corporations that dominate the American market. Of those five, I.P. is the largest, and WestRock the second largest, with Georgia Pacific, the Packaging Corporation of America and Pratt following closely behind. All are “vertically integrated” — they have harvesting and pulping capabilities as well as box-making plants and distribution networks — and most have grown, like predatory aquarium fish, by devouring their smaller peers. “I remember when I was hired at Smithers in 2021, I saw this data set that had two columns,” Cooper recalled. “The left column had the landscape as it existed a decade ago, and the right column was the landscape now. It has gone from 1,000 companies to half of that: 500 total. That’s how an I.P. or a WestRock got to where they are today. They acquired lots of regional players. And with each new acquisition, they got more powerful.” Cooper estimates that in 2022, the combined market share of the Big Five has come to rest at roughly 70 percent of the corrugate industry in the United States.

Globally, corrugated packaging markets tend to be more fragmented, especially in Europe, with its multitude of borders and languages. But on a per-capita basis, Europeans use nearly as much cardboard as we do; residents of Africa and the Middle East use considerably less. (Amazon Prime shipping is not yet available in almost all of these regions.) But give it time. This spring, Smurfit Kappa, an Irish paper company, announced it would pour $35 million into a 270,000-square-foot packaging factory in Morocco. The plant will join a nascent network of paper plants and mills that some analysts expect will drive the African and Middle Eastern market to $1.9 billion in revenue by 2029.

The largest and fastest-growing market for corrugate is China, home to both an expanding middle class and the e-commerce giant Alibaba. Surprisingly, China does not produce much of its own pulp. It can’t; it doesn’t have enough of the right kinds of trees. (The most famous global cardboard baron is 65-year-old Zhang Yin, the China-born “Queen of Trash” and the proprietor of a multinational conglomerate that got its start by collecting wastepaper from North America and shipping it to Asia for conversion into cardboard.) “The Chinese market was, for a lot of decades, a recycled-paper market,” says Oskar Lingqvist, the head of McKinsey’s Paper and Forest Products and Packaging division. But then in 2017, as part of an ongoing trade war with the West, the government enacted a ban on all imported waste, from plastics to used cardboard. “So now,” Lingqvist added, “you’ve got an industry that’s struggling to find ways to reinvent itself: by importing pulp from Russia, by building up wood plantations in Vietnam and Laos. And by experimenting with new usages of pulp from native fibers like bamboo.”

In its hunger for corrugate, China is helping to reshape the global economy, often in profound and lasting ways. “What we’ve witnessed is an explosion of Brazilian companies shifting into the containerboard space — planting and harvesting pine trees with the express aim of sending the pulp to China,” Bruno Kanieski da Silva, a Brazil native and an assistant professor of forest management and economics at Mississippi State University, told me. Much of the exported pulp is derived from eucalyptus and loblolly pine, which are not native to South America but have responded exceptionally well to the local climate, with its humidity, heat and lashings of rain — a loblolly planted in a Brazilian tree farm will grow considerably faster than one planted here.

Over the past half decade, all this new activity — in South America, in Russia, in the fiber basins of both the Southeastern United States and Southeast Asia — has contributed to ever-more-vast output figures. In 2020, for example, the world’s paper and cardboard factories produced an estimated 400-million-plus metric tons of product; by 2032, analysts have predicted, that number will rocket to 1.6 billion metric tons, the weight of 16,000 aircraft carriers. Safe to say that never in human history have we relied on one kind of mass-produced packaging material for so much, and certainly not at such scale. There’s something awesome about that achievement, in the oldest sense of the word, and also something a little anxiety-inducing. It reminds us, if we care enough to dwell on it, what the box boom is really about, which is capitalism and buying lots of stuff and above all, instant gratification — even if that gratification involves a bottle of conditioner shipped through three ports, one fulfillment center and hundreds of miles of highway.

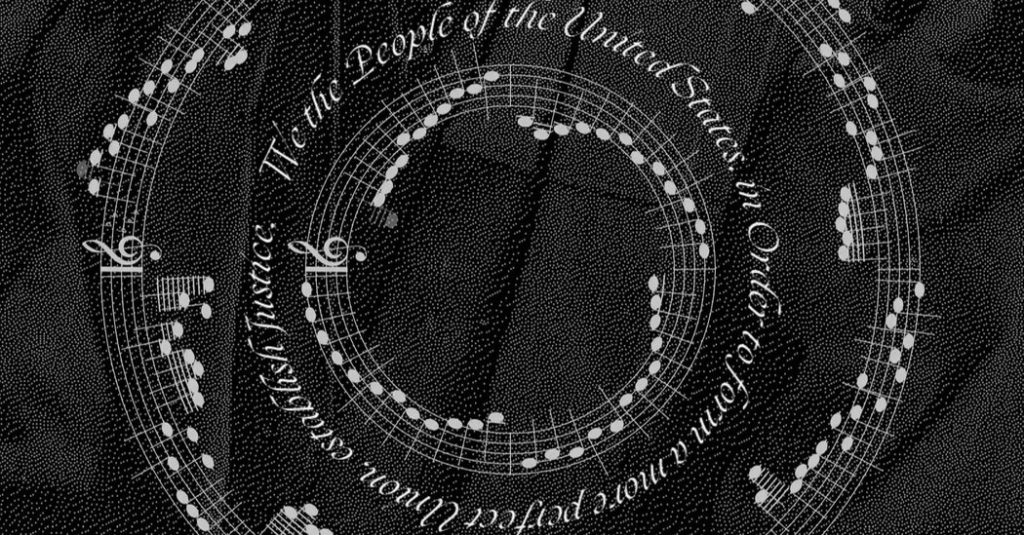

Given its symbiotic relationship with commerce, it should be no surprise that the progenitor of the mass-produced cardboard box, a Scottish émigré named Robert Gair, was himself a manufacturer. Gair arrived in the United States in the mid-19th century, fought in the Civil War on the side of the Union and in 1864 opened his first paper-bag-printing factory in New York. He probably would have forever remained a bag man had one of his machines not malfunctioned in such a way that the sacks came off the line marred by a series of horizontal slices. Eureka! If a machine could be inadvertently programmed to slice open a paper bag, Gair reasoned, it could be purposefully programmed to slice and precrease stacks of paper. “Shortly after this,” in 1870, The Times later noted, “he made the first folding boxes, and the idea was an instant success.”

The Times had it half right: Gair wasn’t the first inventor to experiment with a folding paper box (“pasteboard” boxes, made up of a patchwork of scrap paper, were in limited circulation as early as the 1700s). But he was the first to automate the operation. And as is often the case when it comes to winning inventions, timing was on his side — in the United States and Europe, an era of rapid industrialization and mass production was well underway, and companies needed an affordable, safe way to ship and display their goods. Soon, Gair expanded into a new factory in North Brooklyn, near the foot of the Brooklyn Bridge. (Such was his dominion over the neighborhood that Dumbo was for a time colloquially referred to as “Gairville.”) Then in 1884, word arrived that a German chemist, Carl Dahl, had perfected his kraft process, which was a vast improvement on time-consuming hand-pulping methods. Once more, Gair benefited from being in the right place at the right time. He invested in kraft vats, and when corrugating technology reached in America, he invested in that too, allowing him to produce bigger, stronger boxes capable of carrying heavier cargo, like sugar and coffee beans. At the time of his death, in 1927, Gair had six factories and thousands of employees; he was “many times a millionaire,” The Times noted in his obituary — no small feat, considering a million dollars in 1927 would be commensurate with almost $17 million today.

And yet what may be most impressive about Gair’s success was how durable it proved. Box-making technology is undoubtedly more refined in 2022 than it was in Gair’s day, “but the underlying process, the underlying science — a lot of it would be familiar to someone who worked in the industry 20, 30, 40, 50 years ago or more,” a veteran packaging man named Troy McDaniel told me recently. “A lot of the bones are the same, you could say. It’s just that everything is faster, more efficient, safer. There’s more output and more customization.”

When I visited the International Paper box plant McDaniel manages, in the Georgia city Lithonia, he led me to a shelf of boxes recently ordered by I.P. clients — Amazon and Procter & Gamble were each well represented, but so was a nearby pizzeria. The boxes varied in color, in shape, in strength. Some were printed with just a logo and a bar code, while others were dressed up in elaborate, photorealistic graphics. “I like to say we have a million and a half ways to make a box,” McDaniel told me. “More, really, because there are a million and a half box designs in the I.P. catalog, but customers can always order new ones. So check back in a couple years. We’ll probably be at two million.” He clapped a hand on my shoulder. “C’mon. Let’s see the magic get made.”

We walked together to the western edge of the box plant, to a loading room stacked to the ceiling with rolls of containerboard. As was the case at the paper mill in Rome, the facility was dominated by a single, tremendously expensive machine — here, a multimillion-dollar corrugator, into which the containerboard was fed at a velocity of 1,200 feet per minute. “Every box order we get is going to come with a list of specs,” McDaniel explained. A smartphone manufacturer might want 5,000 24-inch boxes with a light grade of corrugate strength. But if the order originates with a poultry producer, the boxes are going to be larger, significantly stronger in composition and corrugation and lined with a coating to prevent leakage.

Perhaps, in the course of breaking down a cardboard box, you’ve stopped to look at an individual panel of corrugate and noticed its resemblance to a deli sandwich. There’s a top and a bottom, and between them is a bunch of ridged or diagonally reinforced filler called “fluting.” That fluting is what gives a cardboard box its protective quality; without its flutes, corrugate wouldn’t be corrugate at all — it would just be containerboard. International Paper customers choose from a fluting guide that extends from A-flute at the thickest to so-called microflutes like E and F.

“Fluting happens at the top,” McDaniel said, indicating a series of whirring cogs on the corrugator that folded the paper into tiny creases — origami at industrial scale. “And here,” he continued, walking to the next station, “is where the inside liner gets applied.” Fluting, then the inside liner, and last, the “bridge,” or exterior surface. All three layers are sealed together with cornstarch, which is cooked to boiling and introduced via the corrugator’s dosing tank. The starch goes on wet; it’s dried, or “cured,” by an array of heated metal plates. Sandwich complete.

McDaniel looked up at an LED scoreboard suspended from the factory ceiling. It showed both the remaining footage in the current order and the processing speed of the corrugating machine. “Three hundred feet per minute,” McDaniel said with a nod. “Just about exactly where we want it.” The machine, at optimal speeds, can hit around 1,000 feet per minute.

The farther we got on the assembly line, I noticed, the more advanced the technology. There were the robotic cranes, with their curved talons. There was the “Flexo,” short for “flexographic printing device” — a gadget capable of slapping a logo and bar code onto a dozen boxes in the amount of time it takes to say “flexographic printing device.” And there was the hypnotizingly wonderful rotary die cutter, which sucked up cardboard and sent a cutting die across the surface. Brip, brip, blat.

What there were not, at the plant, were people — not many of them, anyway. It was the same at the paper mill. In the era of Robert Gair, much of the hard work of box-making was managed by large teams of factory workers; even early automated machines needed constant minding. The modern process is considerably more streamlined, far less prone to breakdown and far more conducive to the scale of the industry: A machine like the die cutter can do the work of a team of men, and it can do it around the clock.

Once the corrugate came through the Flexo or the die cutter, it was stacked and sent over a series of rollers to a door at the back of the warehouse — because it would be inefficient to ship assembled boxes to the customer, actual box construction is typically handled by the buyer. I watched each new stack vanish into the darkness. I got up to 200 before I decided to stop counting.

Last year 5 percent of the plastic waste consumed in the United States was recycled back into plastic; the remainder was deposited in landfills around the country, where it is almost certainly still moldering today. Rates for glass were a little better, at 31 percent, and aluminum was better still — half of all the cans consumed annually by Americans were reintroduced into the supply chain. But no widely available shipping or packaging material can match cardboard’s recyclability, which hovers annually between 90 and 91 percent.

Consumers, as many companies have been quick to understand, tend to have a pretty good sense of this kind of thing, even if they’re not capable of reciting recycling stats for each type of container. “It’s true that you never buy a package — you’re buying what’s inside it,” Cooper, the Smithers analyst, told me. “But as a society, we’ve come to expect sustainability in everything we consume.” He went on: “So for Company X the decision to rely more on cardboard is a business decision. And it’s a good one.” At the grocery store closest to my house, cherry tomatoes that were once sealed in plastic are now available in lightly corrugated boxes; in the beverage aisle, carton-board boxes of water sit alongside the six-packs of cans. My favorite takeout place has gone paper-only: paper bags, corrugated clamshells instead of foam.

Most close observers of the packaging business expect the trend to continue for the foreseeable future, across a range of industries and regions. “It’s not to say that plastics or other substrates won’t always have their places,” says Oskar Lingqvist, the paper-industry analyst at McKinsey. “But in a lot of applications, and in a lot of markets, fiber-based materials are sort of lifting themselves up, to the point they could soon be the preferred container.” In a few years, you may be sipping your beer from what amounts to an oversize juice box.

Still, a 91 recyclability rate percent is not 100 percent, and in recent years, the packaging industry has invested millions of dollars in reducing — or more quixotically, eliminating — further waste from the box-making process. In 2021, a British company called Notpla (motto: “We make packaging disappear”) introduced a line of boxes coated with a compostable seaweed product; Ecovative Design, a New York State start-up, is experimenting with mushroom-based packaging. Novel approaches, both, and in time, plant-based boxes could come to supplement their cardboard counterparts. But as the packaging scientists Tom Corrigan and Marcia Popa told me when I visited their lab on the 3M campus in Saint Paul, Minn., scale is the major obstacle: Trees are big. Mushrooms are small. You’d have to harvest a prodigious number of mycelium to rival the output of a pulp mill.

“Paper is a lot more, well, available,” Popa said.

“The infrastructure is in place,” her colleague agreed.

Corrigan is lean and tall; with his unguarded effusiveness and sandy, unkempt hair, he calls to mind a middle-school science teacher. A few years ago, he told me, he became “completely fixated on the idea of using paper to help make better conformable packaging” — a fiber-based version of Bubble Wrap, essentially, that could help cut down on the amount of dead air in a package. The material would have to be both thin enough to ship and expandable, in order to fill the space in a box, preventing the protected object from slamming around inside. Ultimately, he found his inspiration in a book about the Japanese art of kirigami, a form of origami that incorporates cutting and slicing. “One Fourth of July,” he recalled, “I went to the hammock in my backyard, and sketched out a bunch of concepts,” basing the sketches on the designs he’d seen in the kirigami book. “And what I realized was that if you made the right perforations, you could get paper packaging that would expand and contract exactly like an accordion.”

For months, Corrigan, Popa and a small team prototyped the material, which was released earlier this year by 3M under the name Cushion Lock. “Sometimes it’d just be me with an X-acto knife, and sometimes I’d use a CAD program and have it laser-cut here in the lab,” Corrigan said. “It was all about perfecting the pattern and the protectivity.” As part of their testing regimen, Corrigan’s team would wrap random objects in Cushion Lock and drop them from various heights. Corrigan handed me a spool of Cushion Lock. It compressed as fluidly as if it were made of water. “It gets distributed as a dense roll of paper, right?” Corrigan said. “But it can expand to 60 times its volume. So you’re saving a ton of storage space.”

Officially, 3M has positioned Cushion Lock as a packaging aid rather than as packaging itself; it has no stackability nor rigidity, and thus no crush protection. But Corrigan and Popa told me they could envision other applications: With the addition of a containerboard liner, Cushion Lock might become a lightweight and recyclable pouch or mailer, able to conform to nonbreakable objects like clothing with an exactitude that a box wouldn’t be able to match.

As it happens, there is an industry term for this kind of approach: right-sizing. “Cardboard boxes are great, but they tend to be oversize, and they tend to be rigid,” says Pat Lindner, the vice president of packaging and innovation at Amazon. If they’re not packed intelligently, the customer can end up with a ratio of 90 percent air to 10 percent product, which is wasteful and damaging: Few of us are not familiar with the sensation of slicing open a large box only to find a single object inside, loose as a pinball and often broken into pieces.

Amazon recently improved an algorithm to determine the optimal box size for each product; it is now used, the company says, in 12 regions around the globe, and in 65 percent of global shipments. “What we’re able to do is put the box around the object in such a way that you’re not shipping air,” Lindner told me. “You don’t have to put additional packaging in there.”

He went on: “I’d say that in general, our main thought around packaging is that we want to reduce it. We want to reduce it wherever we can, and we want it to be the minimum amount essential so that the customer gets the product the way that they ordered it and the way that they wanted to receive it.” Along with right-sizing, Amazon now allows consumers to choose how their products are packaged — and whether they’re packaged at all. Place a few items in your Amazon cart, and you’ll notice that you’re able to have the products shipped together in one box, provided you’re willing to wait (combining deliveries means the delivery speed will only be as fast as the slowest item to ship). In some cases, items will arrive without any box, which has started to happen with the canned tea I often order from Amazon. A year ago, the cases, which are prepackaged in cardboard stamped with the logo of the manufacturer, showed up at my house in a second layer of Amazon-branded corrugated packaging. Now the second layer is gone. Amazon says that in 2021, more than two million products qualified for shipping without additional packaging.

Amazon prefers to refer to its sustainability initiatives as a matter of corporate responsibility: The most profligate shipper of boxes should be mindful of its environmental impact. But as Lindner acknowledged, in a few years the company may not have much of a choice. Of the 30 countries included in a recent packaging survey by McKinsey, 24 had regulations related to the reduction or limitation of shipping materials. Twenty-two have implemented rules on industrial waste collection and sorting, and what’s known as extended producer-responsibility (or E.P.R.) regulations — laws that pay companies to prioritize the most recyclable shipping methods. In the United States, many states are offering substantial tax incentives for companies that prioritize right-sized corrugated packaging; in May, an assemblyman in New Jersey, John McKeon, went so far as to propose a bill that would fine retailers up to $500 each time they shipped an item in a cardboard box more than twice as large as the product inside. The bill is now in committee, and could get a vote as soon as January.

Late last year, International Paper announced it would build a new plant in Atglen, Pa., a town about an hour’s drive west of Philadelphia. When the facility is complete, in early 2023, it will employ more than 130 people and serve as an additional bridge between the company’s network of Southern pulp mills and the markets across the Northeast. The Atglen plant is by no means the only facility set to open soon: WestRock is building a corrugated-box facility in western Washington State, and the packager Rand-Whitney has broken ground on what it calls a “world class” plant in Massachusetts that it says will have the capability to produce 300 million boxes annually.

To a significant extent, the plant openings represent the widespread belief that demand for corrugated packaging will continue to swell, even as major retailers test out reduction and right-sizing initiatives. A right-sized cardboard box is still a box, and the box will still need a manufacturer, and a pulp mill, and a fiber supply manager like Alex Singleton. Factor in the gradual replacement of other forms of packaging with cardboard, and you can understand why the industry is so bullish on its prospects for long-term growth.

And as it grows, the environment around us is also likely to change, albeit more slowly and less drastically than it has in a place like Brazil, with its new commitment to servicing the Asian cardboard market. The best way to envision that change, says Robert Abt, an emeritus professor at North Carolina State’s Department of Forestry and Environmental Resources, is to use the American South as an example. In Georgia and Alabama, family operations have given way to small empires of tree plantations, built largely on private land, and largely by planting pines in a region where other types of trees — or other varieties of crops, like cotton — once grew. “For a lot of folks, it’s a matter of adjustment,” says Abt, who grew up in the industry: His father worked for a paper company in Georgia. “You’re pivoting to where the profit is.”

This spring, I drove with Alex Singleton past the city limits of Rome, and into an undulating tract of family-owned forest. Jamie Jordan, an owner of the land, was waiting at the entrance to his tree farm, his hands jammed into the pockets of a well-worn pair of jeans. His son, Jesse Jordan, stood next to him. “We’ve always been farmers, as far back as any of us can remember,” Jamie said. “It was my daddy, and his daddy before that, and so on, and then it was me, and soon it’ll be Jesse here,” Jamie continued. “And we grew it all: vegetables, corn, cotton.” These days, the Jordans grow a lot of pine, sending much of the pulpwood to the I.P. mill in Rome. “Now we’re on our third harvest,” Jesse said.

We climbed in the truck and rattled down a dirt road that became a rutted track that became a shallow set of depressions in the earth. The forest closed around us; a deer shuddered through the undergrowth. A red squirrel stared back at us from a mound of loam.

But mostly it was just pines, pines, as far as the eye could see.

Matthew Shaer is a contributing writer for the magazine, an Emerson Collective fellow at New America and a founder of the podcast studio Campside Media. Christopher Payne is a photographer who specializes in architecture and American industry. His next book, “Made in America,” is scheduled to be published by Abrams in 2023.