His Brownstone Is Worth $5.4 Million. Why Is His Tax Bill So Low?

New York City is known for its pricey real estate, but some homeowners get an unexpected bargain: Property taxes on some of the fanciest, most coveted properties are often very low — at least relatively.

The flip side? Renters and homeowners in lower-income neighborhoods end up carrying a lot of the burden.

Take, for example, a $5.4 million brownstone in Brooklyn’s Park Slope. Its annual property tax bill is around $12,000 — about 0.2 percent of the home’s overall worth. Now compare that with the $7,500 tax bill for a $780,000 home in the Bronx. The cheaper home has an effective property tax rate almost four times higher.

Both bills are lower than in much of the suburbs, where property taxes for less valuable homes routinely top $25,000.

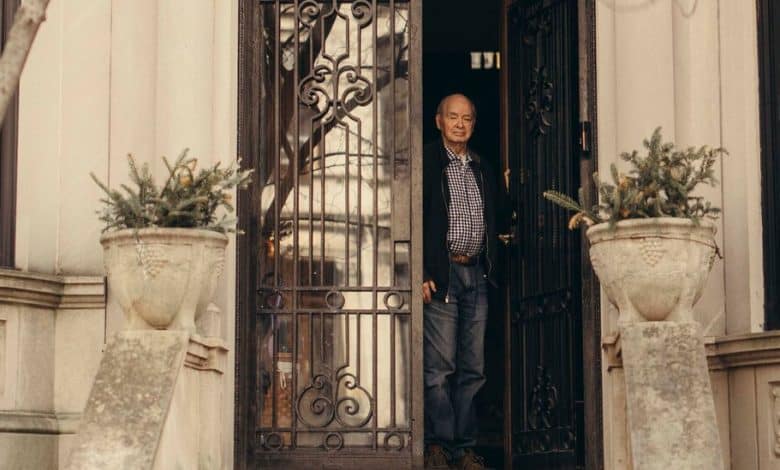

“I don’t think it’s fair,” said Mark Young, 60, who owns the brownstone.

Nearly everyone in New York agrees with him. Under the city’s property tax system, which is broadly criticized as opaque and unjust, lower-income homeowners and owners of big apartment buildings pay more relative to the value of their properties. Several mayors have unsuccessfully pledged to mend the resulting racial and economic disparities.

Now, a decision from the state’s highest court has made it much more likely that the city will be forced to make changes. The decision was procedural, essentially allowing the case to move forward. But the court rejected some of the city’s methods that have led to the unevenness.