Officials of OPEC and its major allies agreed on Monday to modestly cut oil production by 100,000 barrels a day.

The trim is so small — about a tenth of a percent of world output — that it will have little practical impact on supplies. But it is likely to be interpreted by oil markets as signaling a new direction after over a year of gradual increases. Futures prices for Brent crude, the international benchmark, were up by 3.8 percent on Monday to about $96.30 a barrel.

In a news release, the group said that September’s production increase of the same size was only intended for one month. It added that “higher volatility and increased uncertainties” require “require continuous assessment of market conditions and readiness” to make immediate adjustments to production.

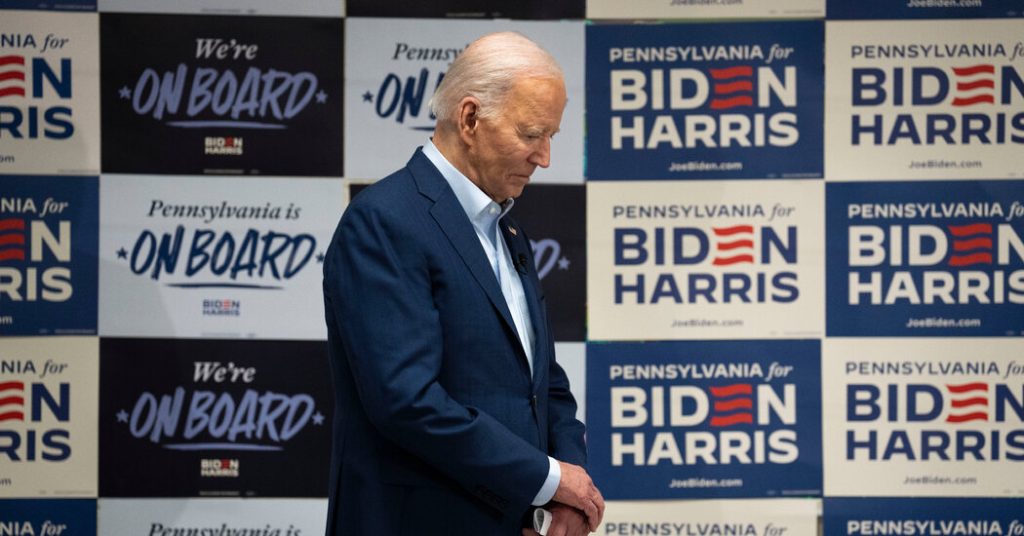

By trimming production, even by a small amount, OPEC Plus is demonstrating that it is willing to shrug off the entreaties of the Biden administration, which has been lobbying Saudi Arabia, the United Arab Emirates and other producers to increase output to help bring down the price of gasoline in part to avoid a backlash against higher energy prices resulting from the war in Ukraine. The cut “sets up a confrontation in terms of expectations of Western developed economies versus the Gulf States,” said Richard Bronze, head of geopolitics at Energy Aspects, a market research firm.

OPEC officials, led by Saudi Arabia, have expressed alarm at the recent slide in the price of oil. “They are determined to stop prices from falling too much,” said a note to clients from Energy Aspects.

Two big unknowns haunt the market. One is how long renewed Covid lockdowns in China, the world’s largest oil importer, will continue to sap demand there. The second is whether a deal will be reached over Iran’s nuclear program that could eventually unleash substantial volumes of new Iranian oil on the market.

Saudi Arabia, which chairs OPEC Plus, has been reminding the markets recently that it is ready to intervene if it sees a danger of price declines running out of control. Saudi Arabia is also sending a signal to the Biden administration that the kingdom is prepared to take steps, like cutting production, that might pre-empt the downward pressure on oil pricesfrom a nuclear deal with Iran.

The OPEC Plus decision is more a signal to the markets. Oil production quotas of many of the group’s members differ widely from what these countries are actually pumping.

For example, while oil production in Russia, a member of OPEC Plus, has held up better under sanctions than many forecasters predicted, the country fell about one million barrels a day short of its target in July, according to estimates from the International Energy Agency.

In July, OPEC Plus was nearly three million barrels a day short of its combined targets, according to the I.E.A. Such shortfalls are likely to continue in coming months as sanctions tighten on Russia, and as other countries, like Nigeria and Angola, are unable to meet their quotas because of a lack of investment and operational constraints.